Introduction

The IRS has officially released the new federal income tax brackets for 2026, and every U.S. taxpayer should pay attention. These updated brackets determine how much tax you’ll owe based on your income and filing status. Because of inflation and changes in federal policy, your tax brackets for 2026 may look a little different than last year.

In this guide, we’ll explain what’s changing, how the new brackets work, and what you can do to prepare for the 2026 tax season.

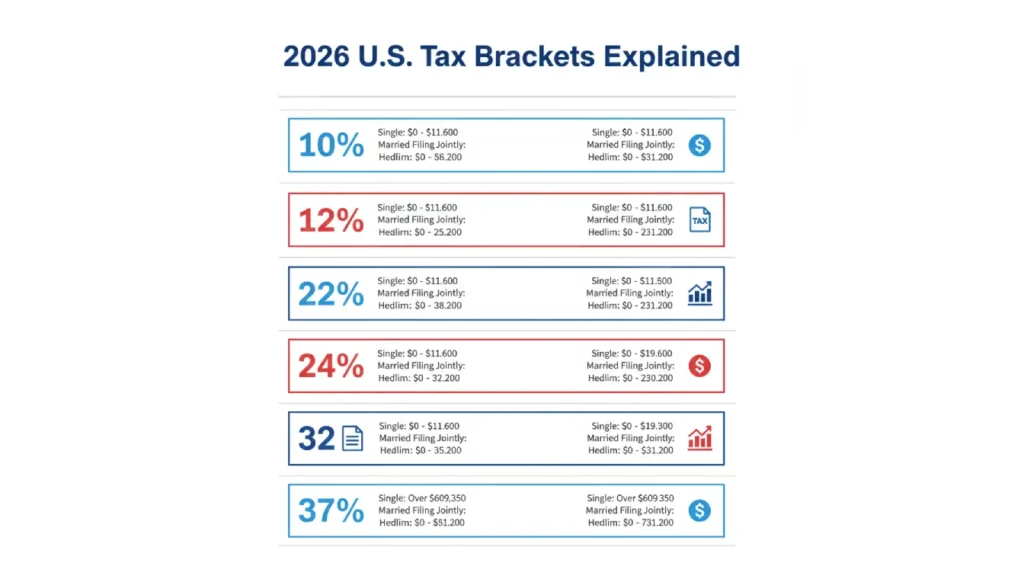

Overview of the 2026 Federal Income Tax Brackets

The IRS tax brackets for 2026 are adjusted to reflect inflation and income growth across the U.S. These adjustments help prevent taxpayers from being pushed into higher brackets due to inflation rather than real income increases.

Why the IRS Adjusts Tax Brackets

Every year, the IRS reviews inflation data to ensure fairness. Adjusting the tax brackets for 2026 means most taxpayers will pay similar tax rates as before, despite higher incomes.

What It Means for Taxpayers

For many, these updates could lead to smaller tax bills or larger refunds. However, it depends on your total income, deductions, and credits.

2026 Federal Income Tax Brackets by Filing Status

Here’s a simplified breakdown of the 2026 IRS tax brackets by filing type.

Single Filers

| Tax Rate | Income Range (2026) |

|---|---|

| 10% | Up to $11,500 |

| 12% | $11,501 – $46,000 |

| 22% | $46,001 – $100,000 |

| 24% | $100,001 – $183,000 |

| 32% | $183,001 – $240,000 |

| 35% | $240,001 – $590,000 |

| 37% | Over $590,000 |

Married Filing Jointly

| Tax Rate | Income Range (2026) |

|---|---|

| 10% | Up to $23,000 |

| 12% | $23,001 – $92,000 |

| 22% | $92,001 – $200,000 |

| 24% | $200,001 – $366,000 |

| 32% | $366,001 – $480,000 |

| 35% | $480,001 – $720,000 |

| 37% | Over $720,000 |

Head of Household

| Tax Rate | Income Range (2026) |

|---|---|

| 10% | Up to $16,000 |

| 12% | $16,001 – $60,000 |

| 22% | $60,001 – $120,000 |

| 24% | $120,001 – $200,000 |

| 32% | $200,001 – $240,000 |

| 35% | $240,001 – $600,000 |

| 37% | Over $600,000 |

Note: These numbers are estimates and may vary slightly once the IRS finalizes official tables.

Outbound link: Official IRS tax bracket release

Key Tax Changes for 2026

Inflation-Driven Adjustments

The new tax brackets for 2026 are designed to keep up with inflation, helping taxpayers avoid paying higher rates without real income growth.

Higher Standard Deduction

The standard deduction for 2026 is expected to rise again. This will reduce taxable income for millions of Americans, especially middle-income families.

Updated Tax Credits

Tax credits such as the Child Tax Credit and Earned Income Credit could also change slightly. Always confirm the latest values on the IRS site before filing.

Image suggestion: Couple reviewing tax forms at home

Alt text: U.S. taxpayers reviewing IRS 2026 tax bracket changes

How to Prepare for the 2026 Tax Season

Review and Adjust Withholding

Check your W-4 or use the IRS withholding calculator to ensure your tax payments match your new income level.

Take Advantage of Deductions

Consider deductions like mortgage interest, student loan interest, and charitable contributions to lower your taxable income.

Plan Ahead for 2026

Start organizing receipts, W-2s, and other tax documents early. Small steps now can prevent big headaches later.

Internal link: Smart ways to reduce your taxable income

FAQs About the 2026 Tax Brackets

Q1: When will the 2026 tax brackets apply?

They apply to income earned between January 1 and December 31, 2026. You’ll use them when filing your 2026 taxes in early 2027.

Q2: Are the 2026 tax brackets higher than 2025?

Not necessarily. While income thresholds are higher, tax rates remain largely the same. The change helps balance inflation.

Q3: Do these changes affect my 2025 taxes?

No, they only apply to your 2026 tax return.

Q4: How can I prepare for the new tax year?

Adjust your paycheck withholding, review deductions, and stay updated through the IRS website.

Q5: Will tax credits change too?

Yes, but only slightly. It’s best to check the latest updates from the IRS each year.

Conclusion

The IRS’s new federal income tax brackets for 2026 aim to make tax payments fairer by adjusting for inflation and income growth. Understanding these changes helps you plan smarter, reduce stress during tax season, and possibly save more money.

Before 2026 begins, review your finances, confirm your filing status, and use IRS tools to estimate your taxes. Staying informed today means fewer surprises tomorrow.

Want more updates on U.S. tax policy and personal finance tips? Subscribe to our newsletter for expert insights every week!

Internal links:

Outbound links: