Introduction

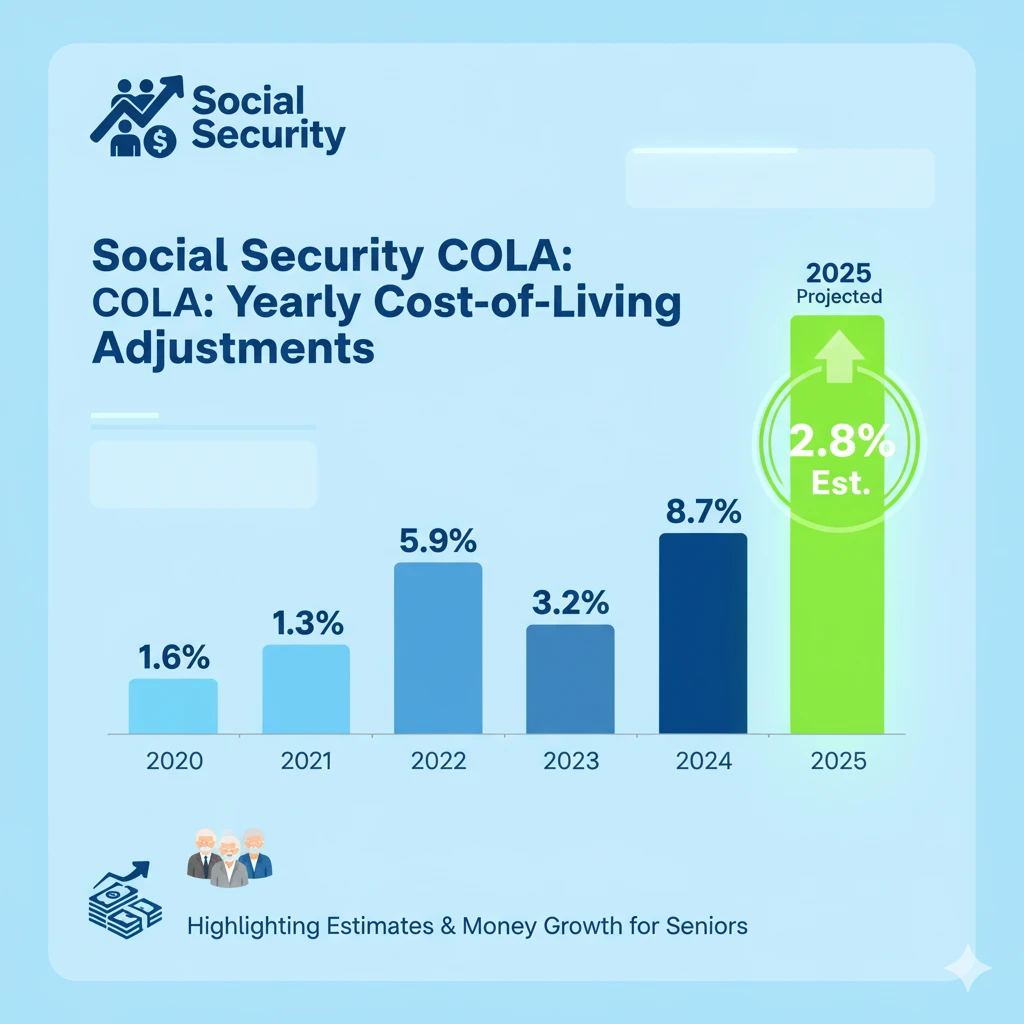

The Social Security Administration has announced that federal retirees and Social Security beneficiaries will receive a 2.8% Cost-of-Living Adjustment (COLA) in 2026. While this is good news for many, some retirees will see smaller increases depending on their retirement system and benefit type. In this article, we’ll explain what the 2026 COLA means, why the increase varies, and how it impacts your retirement income.

What Is the 2026 Social Security COLA?

The Cost-of-Living Adjustment (COLA) helps protect retirees’ purchasing power by adjusting benefits to match inflation. The 2.8% increase for 2026 reflects the Consumer Price Index (CPI-W) rise over the past year.

How COLA Works

The Social Security Administration calculates COLA based on inflation data from the third quarter of the previous year. When prices for goods and services rise, COLA increases Social Security and federal retirement payments accordingly.

Why Some Retirees Get Different Increases

Not everyone receives the same COLA percentage. For example, Civil Service Retirement System (CSRS) retirees get the full COLA, while Federal Employees Retirement System (FERS) retirees may see smaller adjustments—typically if the COLA is over 2%.

Who Will Benefit Most from the 2026 COLA?

Federal Retirees under CSRS

Retirees under the Civil Service Retirement System (CSRS) will get the full 2.8% COLA. This system directly links adjustments to inflation, offering maximum protection for purchasing power.

Federal Retirees under FERS

Those covered by the Federal Employees Retirement System (FERS) will see smaller increases due to the formula used. If COLA is above 2%, FERS retirees usually get the CPI increase minus 1%. That means many will receive around 1.8% instead of 2.8%.

Learn about FERS and CSRS differences on OPM.gov

How the 2026 COLA Affects Social Security Benefits

Example of a Monthly Increase

If you currently receive $2,000 a month from Social Security, a 2.8% increase means an extra $56 per month. That’s about $672 more per year.

Impact on Future Retirees

For people planning to retire soon, the 2026 COLA could slightly improve their projected Social Security income. However, inflation may still offset part of the gain.

Read our guide to maximizing Social Security benefits

Why Some Will See Smaller Social Security Increases

Medicare Premium Adjustments

If Medicare Part B premiums increase, some retirees may see smaller net payments. The premium hike can offset part of the COLA, reducing take-home benefits.

Tax Brackets and Withholdings

Higher Social Security payments can also push some retirees into higher tax brackets, leading to more taxes withheld from benefits.

Official Social Security COLA updates

Image suggestion: Graph showing COLA increase vs. Medicare premium growth

Alt text: Social Security COLA and Medicare premium comparison chart

Tips to Make the Most of Your 2026 Social Security Increase

Review Your Budget

Use the extra income wisely. Review your monthly spending and adjust savings or emergency funds if needed.

Recalculate Taxes

A COLA increase might affect your taxable income. Check if you need to update your tax withholding or consult a financial advisor.

Delay Withdrawals

If you can, delay withdrawals from retirement savings accounts like IRAs to maximize long-term growth and minimize taxes.

See how to plan your retirement income effectively

FAQs About the 2026 Social Security COLA

Q1: What is the Social Security COLA for 2026?

The COLA for 2026 is 2.8%, based on the inflation rate measured by the CPI-W.

Q2: Will everyone get the full 2.8% increase?

No. Some federal retirees under FERS may get smaller increases due to COLA adjustment formulas.

Q3: When will the 2026 COLA take effect?

The increase will start with January 2026 payments.

Q4: How does COLA protect against inflation?

It adjusts your Social Security and retirement income to maintain purchasing power as living costs rise.

Q5: Does Medicare reduce the COLA benefit?

Yes, if Medicare premiums increase, they can reduce the net amount retirees receive.

Conclusion

The 2026 Social Security COLA brings a 2.8% boost for most federal retirees, though some will see smaller increases. While it helps offset inflation, understanding how COLA interacts with taxes and Medicare is key to maximizing your retirement income. Stay informed, review your finances, and make the most of your benefits.

Keep up with the latest Social Security news and retirement updates—subscribe to our newsletter for expert tips every month.